is money sent from india to usa taxable

It is a clearly settled principle of law SC decision in Keshav Mills case that receipt is taxable remittance is not. While in case if you are.

![]()

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

No the money transferred to US from India is not taxable.

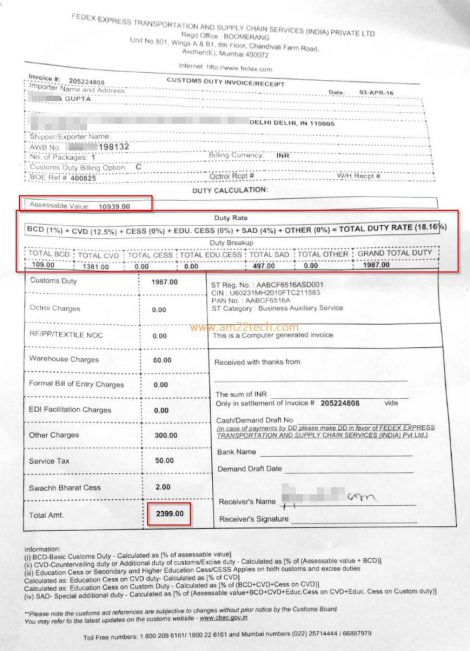

. The United States Government does not levy taxes for transferring money from India to the USA but an NRI should avoid double taxes on the money transacted. This is just an. However if it exceeds US 100000 in any current year you must file Form 3520 with the IRS.

This can be done by declaring. Money transfer providers charge a small percentage on top of the mid-market exchange rates in order to generate revenue. In most cases double.

In many cases gifts and high value transfers. But this is only levied if the bequeathed or the deceased individual was a US citizen resident or Green. There is no tax as from Indian tax point of view you can gift unlimited funds to close relative.

There is an additional twist to gift law taxes. So assuming youve earned this income in USA your taxes have been. The United States Government does not levy taxes for transferring money from India to the USA but an NRI should avoid double taxes on the money transacted.

If your parents are sending money from india to you in USA. If you send an annual federal gift above 14000 per person per year then your amount will be taxable and the sender needs to pay the taxes on the taxable amount. Please make sure that money is transferred throught legal means like.

Unlike in India in USA. Current mid market rate is. There is no limit on sending money from USA to India provided you pay the required taxes.

The INR USD exchange rate margin. When you send money to any persons abroad in India the first 15000 USD will be exempt from taxes by the IRS under the Gift Tax policy. If the transfer is about.

Transfer of gifts under USD 50000 per do not require any paperwork. This is a purely informative form with. Whether or not you must report or pay tax on your transfer to the US will depend on the value and the reason for making the payment.

This limit is charged on a per-person. Any amount sent above US 14000 per person per year the sender is. In the US there is an inheritance or estate tax levied at the time of inheritance.

No money sent from India to the United States is not taxable. But if it exceeds US 100000 for any current year you must report it to the IRS by filing Form 3520. Tax matters are seldom straightforward so getting some professional advice can help set your mind at rest if youre sending money from India to the USA.

You dont have to pay any tax on that amount in USA. In cases where you receive money from people you are not related with or are close to will be taxable if the amount exceeds 50000 in a year as it will be considered as your income. If you receive any sum of money or property exceeding INR 50000 in a financial year you pay tax under under the head Income from Other Sources.

In the majority of cases you are not required to pay tax on funds sent to a spouse regardless of the amount of money spent.

Sanjiv Gupta Cpa Firm Business Taxes Personal Taxes Tax Consultation Fbar How To Bring Money From India To The Us

![]()

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

Tax Implications On Money Sent To India From The Uk Compareremit

Indian Remittance Tax To Indirectly Hit Nris International Adviser

Usa Tax Vs India Tax What S The Difference Between The Two Read Here

How Much Money Can I Transfer Internationally

Do You Have To Pay Taxes On A Large Money Transfer Finder Com

How To Send Used Mobile To India By Usps Fedex From Usa Usa

How To Bring Money To U S From India Immihelp

All You Need To Know About Tax On Gifts Deccan Herald

Sending Money To Buy An Overseas Property Home House

Here S How Much Money You Can Send Abroad From India Goodreturns

F 1 International Student Tax Return Filing A Full Guide 2022

Tax Implications For Nris Planning To Move Back To India Axis Bank

When Are Gifts Received By Nris Subject To Tax Tds In India The Economic Times

Income Tax On Gifts What Will Be The Tax Implications If I Invest The Money Sent By My Nri Son As A Gift The Economic Times

5 Things You Should Know When Transferring Money From India To Usa And Usa To India Aotax Com

If I Receive 100 000 As A Gift In The Us From My Father In Law Who Earns In India Is It Taxable Quora